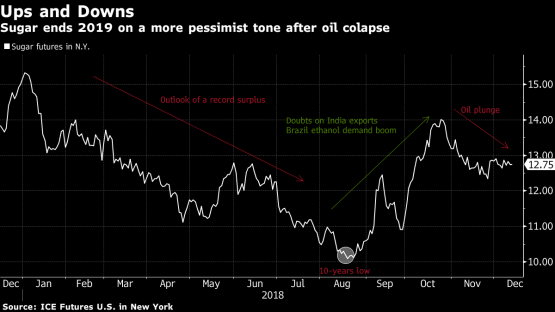

Sugar is ending 2018 on a bitter note on signs that a price collapse could get even worse next year.

Futures have slumped 17% this year, a second straight annual loss, as booming global production sparked a supply glut. The one thing that kept the rout from being even deeper: robust demand for ethanol in Brazil, the world’s biggest sugar grower and exporter. But now that backstop looks like it’s going away.

Cane millers can turn crops into either sweetener or biofuel. For a lot of 2018, high gasoline prices meant Brazilian processors favored making ethanol, helping to cap the sugar glut. The recent plunge for crude oil is signaling that trend is about to reverse.

Most drivers in Brazil own flex-fuel cars that can run on either gasoline or ethanol. Traditionally, consumers choose the alternative fuel when it’s below 70% of the price of gasoline because it yields less energy per liter. Now that crude oil is tumbling, the outlook for traditional fuel consumption is improving, and ethanol prices are slumping as a result.

In 2019, cane millers stand to make as much as 13% more by turning the crop into sweetener instead of biofuel, according to data from consulting firm FGA, based in Ribeirao Preto, Sao Paulo state. That compares with a sugar discount of as much as 30% this year.

Click HERE for the full report.

Sourced: Moneyweb